New Gmail Integration for Seamless Customer Support

New Gmail Integration for Seamless Customer Support At Xima, we continually enhance how customer care teams manage interactions. Our latest enhancement is the Gmail integration

As the digital age continues to rapidly evolve, customer service solutions from Xima have never been more important for businesses within the financial industry. In the past, in-person communication was the primary way for financial advisors and institutions to give the best customer experience possible. Now, one of the biggest challenges they face is engaging in effective communication over the phone or online.

Without the right tools, it can be difficult—if not impossible—to bridge that gap between virtual and personal relationships. Fortunately, recent advances in technology have enabled a game-changing approach: digital communication solutions that allow financial institutions to instantly engage with their clients from any device.

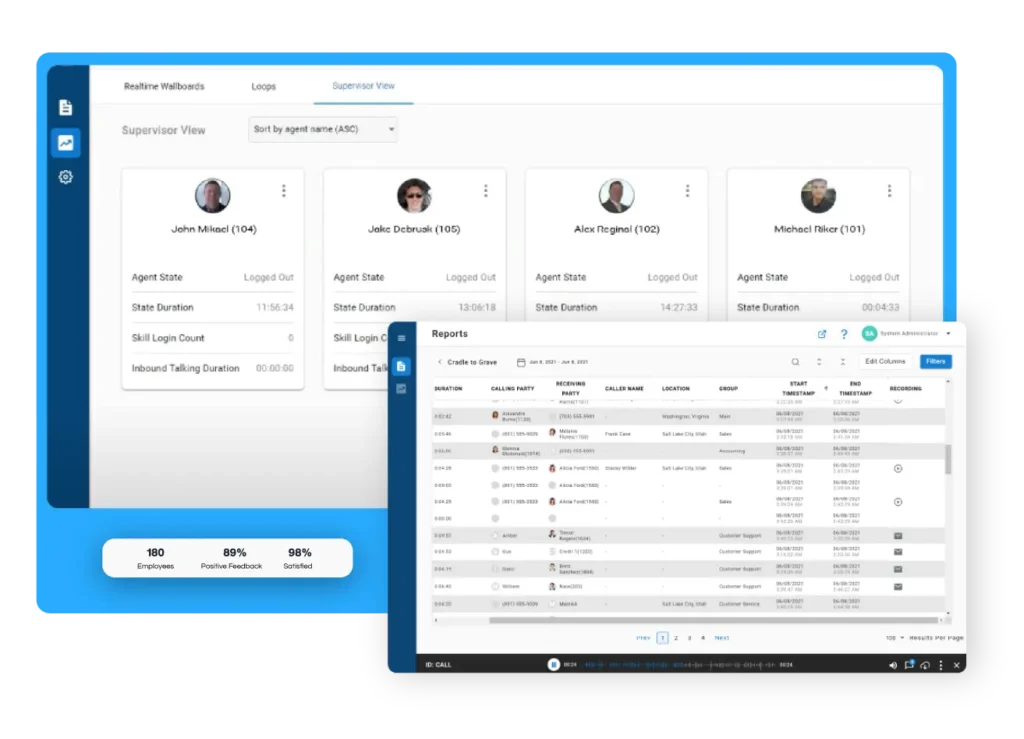

For remote or in-house live agents, cloud-based communication solutions from Xima make it easier than ever before for financial institutions to offer personalized answers and information to their clients. All agents have secure access to the necessary customer data required to improve customer interactions and deliver a truly excellent customer experience.

Today’s fast-paced world requires businesses to stay ahead of the game, especially in the financial industry. Whether you’re a bank, credit union, or credit card company, you need to ensure you provide exceptional customer service to maintain satisfaction and loyalty.

While some people might initially think artificial intelligence (AI) and cloud-based contact center solutions are too impersonal to help people with their banking or bills, the reality is that they can make the process so much easier. These tools from Xima have become game-changers in the financial industry. They empower businesses with innovative resources to automate processes, handle high call volumes, and provide personalized customer experiences.

Xima’s solutions can assist businesses in streamlining their operations to make them more efficient as well as optimizing the use of live agents’ time, providing positive customer interaction every time. As an industry that values efficiency and accuracy, financial institutions will find that AI and cloud-based solutions are valuable assets for the following reasons:

With the increasing need for digital outlets and 24/7 customer service, investing in these technologies can be the catalyst that drives a business to success.

Public vs Private Cloud Use in the Financial Industry

As technology has advanced, businesses have found new ways to store and access their data. In the financial industry, data security is crucial, and companies want to ensure their sensitive information is protected at all times.

This has led to the debate of public versus private cloud use. While public clouds can be more cost-effective and offer more flexibility, private clouds provide higher security. In the financial industry, where regulations are strict and data breaches can be catastrophic, most companies opt for private clouds.

However, with the increasing capabilities and security measures of public clouds, some companies are starting to consider the benefits they offer. For some, it’s only after establishing a private cloud that they add a public cloud infrastructure to their toolkit.

Digital communication has become one of the most prominent ways for businesses in the financial industry to connect with clients. However, with so much information constantly being exchanged online, it can be challenging to build truly strong and impactful relationships. That’s why it’s essential to have a well-defined strategy for how to use digital communication to better engage your clients.

This might include everything from regular email newsletters and personalized follow-up messages, to scheduling virtual meetings and providing helpful online resources. Think about tasks customers can accomplish on their own using your call center’s customized voice response menu or online portal. Just a few of the things they can accomplish on their own without having to wait on hold for a live agent can include:

By implementing these best practices and taking a thoughtful approach to digital communication, businesses can foster stronger connections with clients and ultimately increase their overall satisfaction and loyalty, even if customers never speak to a live agent.

Technology like AI and cloud-based contact center solutions can help financial institutions significantly improve customer experience and relationships. It’s important to identify features that meet your specific business needs. By leveraging digital communication channels, financial service providers can increase efficiency while providing a more personalized customer experience.

Now is the time to invest in the right technologies so you can take advantage of the opportunities of the modern financial industry. Start exploring how AI-driven and cloud-based contact center solutions can enhance the efficiency of your communication channels while giving agents invaluable insights into customer behavior and relationships.

Request a demo from Xima today to see how our services can benefit your business.

With cloud technology, patients can easily access their medical histories and contact the center 24/7. In addition, AI-powered chatbots can provide instant responses to frequently asked questions, easing the burden on call center staff. The adoption of automated technology and AI solutions will not only improve efficiency but also create a better experience for patients seeking healthcare services.

New Gmail Integration for Seamless Customer Support At Xima, we continually enhance how customer care teams manage interactions. Our latest enhancement is the Gmail integration

Direct Routing with Microsoft Teams Now with Xima At Xima Software, we’re dedicated to pushing the boundaries of telecommunications technology to empower businesses like yours.

© 2023 Xima Software

XIMA, Xima logos, and other Xima trademarks are registered or unregistered Xima trademarks in the US and elsewhere. Other names or brands are trademarks of their respective owners.

Join us for an exclusive webinar as we dive into our latest product releases for IVR, MMS Messaging, and our Social Media Integration.

Thursday, September 12, 2024 | 11:00AM ET