Optimizing Healthcare Operations with Real-Time Reporting

Clarity, Accountability, and Smarter Decision-Making for Healthcare Teams

Customer service solutions have never been more important

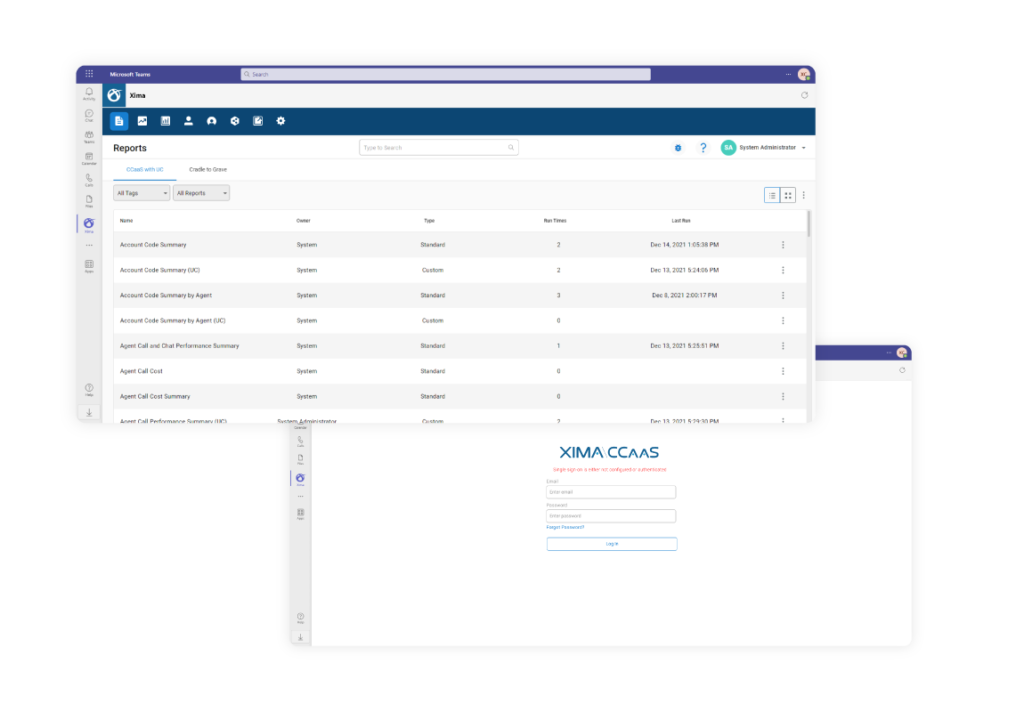

Our advanced contact center software is tailored for modern financial institutions, offering diverse communication channels to reach all customer demographics effectively. We strike the perfect balance between automation and personal touch, ensuring efficient yet personalized interactions.

With security measures and privacy compliance built-in, our platform safeguards sensitive financial information. Additionally, our comprehensive analytics enable you to measure and improve your communication strategies, driving customer satisfaction and institutional success in the digital era.

Let us give you a call

Today’s fast-paced world requires businesses to stay ahead of the game.Whether you’re a bank, credit union, or credit card company, you need to ensure you provide exceptional customer service to maintain satisfaction and loyalty.

While some people might initially think artificial intelligence (AI) and cloud-based contact center solutions are too impersonal to help people with their banking or bills, the reality is that they can make the process so much easier. They empower businesses of any size to automate processes, handle high call volumes, and provide personalized customer experiences.

As an industry that values efficiency and accuracy, financial institutions find that AI and cloud-based solutions are valuable assets for the following reasons:

With the increasing need for digital outlets and 24/7 customer service, investing in these technologies can be the catalyst that drives a business to success.

Sean Murphey – Fairfax Pediatrics Associates

We offer our advanced features at a fraction of the cost of competitors. With fully customizable solutions, you can help your agents stay focused on assisting customers while meeting your bottom line. Never compromise quality for cost when you integrate Xima’s call center software.

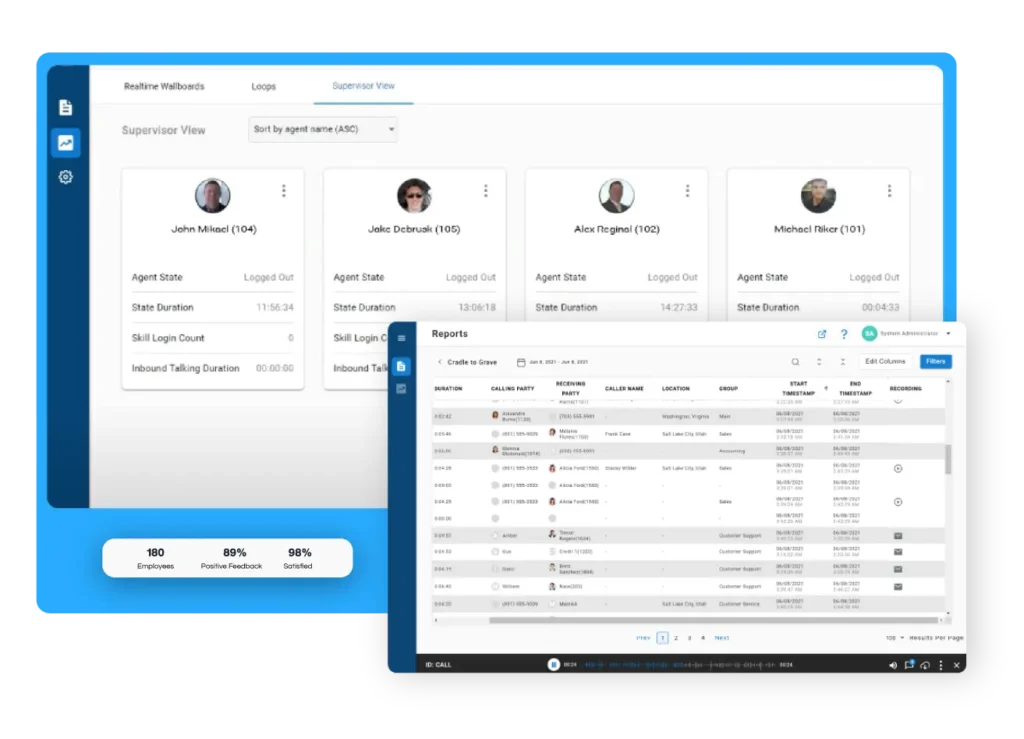

Help your financial service professionals focus on helping customers with needs that fit their specific skills and expertise.

Understand customer insights, identify trends in behavior, and proactively address common issues to deliver a better experience.

Reduce hold times and disconnects during high call times without overwhelming your financial services professional.

Digital communication has become one of the most prominent ways for businesses in the financial industry to connect with clients. However, with so much information constantly being exchanged online, it can take time to build truly strong and impactful relationships. That’s why it’s essential to have a well-defined strategy for how to use digital communication to better engage your clients.

This might include everything from regular email newsletters and personalized follow-up messages, to scheduling virtual meetings and providing helpful online resources. Think about tasks customers can accomplish independently using your call center’s customized voice response menu or online portal.

Just a few of the things they can accomplish on their own without having to wait on hold for a live agent include:

In addition, AI-powered chatbots provide instant responses to frequently asked questions, easing the burden on call center staff.

By implementing these best practices and taking a thoughtful approach to digital communication, businesses can foster stronger connections with clients and ultimately increase their overall satisfaction and loyalty.

Now is the time to invest in the right technologies so you can take advantage of the opportunities of the modern financial industry. Start exploring how AI-driven and cloud-based contact center solutions can enhance the efficiency of your communication channels while giving agents invaluable insights into customer behavior and relationships.

Request a demo from Xima today to see how our services can benefit your business.

Clarity, Accountability, and Smarter Decision-Making for Healthcare Teams

Discover the powerful benefits of chatbots in healthcare, from streamlined communication and improved patient engagement to reduced costs. Learn how AI is revolutionizing patient care.

Discover how AI-powered self-service is transforming patient access in healthcare. Learn how smarter call routing, predictive analytics, and HIPAA-compliant tools reduce hold times and improve satisfaction—for both patients and providers.

© 2025 Xima Software

XIMA, Xima logos, and other Xima trademarks are registered or unregistered Xima trademarks in the US and elsewhere. Other names or brands are trademarks of their respective owners.

Join us for an exclusive webinar as we dive into our latest product releases for IVR, MMS Messaging, and our Social Media Integration.

Thursday, September 12, 2024 | 11:00AM ET