Optimizing Healthcare Operations with Real-Time Reporting

Clarity, Accountability, and Smarter Decision-Making for Healthcare Teams

In the fast-paced world of financial services, contact centers serve as the front lines of member and customer interaction. They are tasked not only with addressing customer concerns but also with enhancing customer experiences in an industry that heavily relies on trust and relationship-building. However, today’s financial services call centers face numerous challenges that can hinder their effectiveness. Let’s explore the top challenges credit union and small banking contact centers encounter and how innovative solutions can transform these obstacles into opportunities for growth.

With advancements in technology, customers now demand quicker, more efficient, and personalized service. The challenge for call centers is to meet these rising expectations without compromising the quality of service.

By incorporating tools such as queue callbacks, flexible call routing, and multiple communication channels (voice, email, text, web chat), call centers can significantly reduce wait times and streamline customer experiences. Providing members with their preferred communication method not only meets expectations but also enhances satisfaction.

SMBs often struggle with the lack of scale and resources compared to larger financial organizations, making it difficult to invest in technology and training.

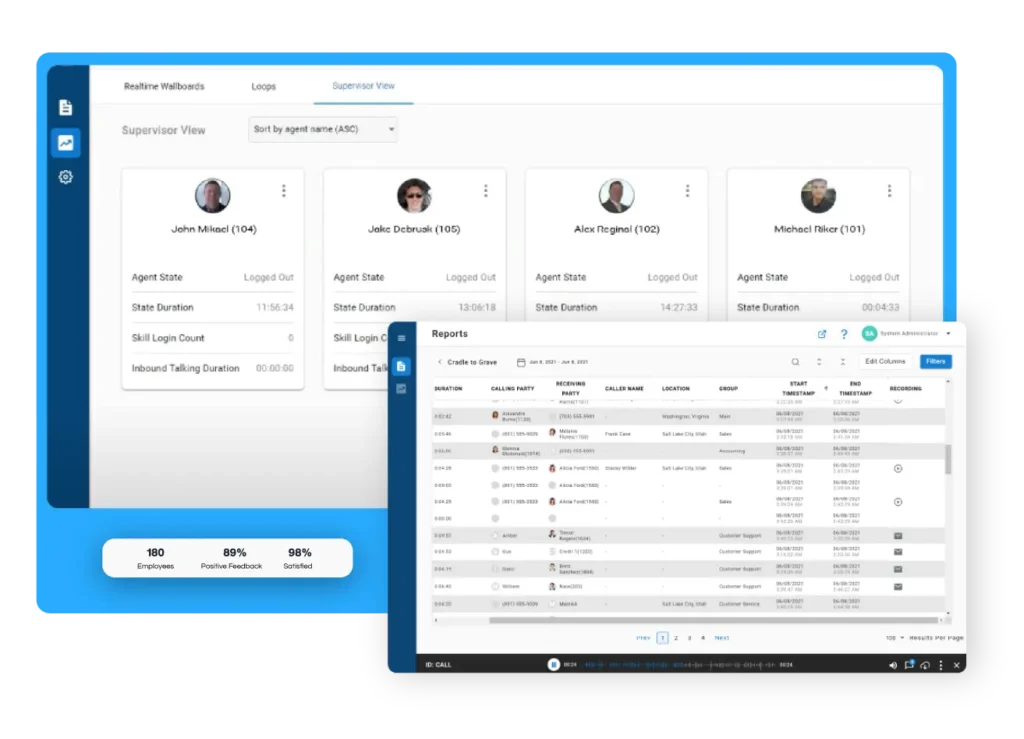

Implementing cloud-based call center software with a trusted partner provides scalable solutions that are cost-effective and rich in features. Cloud solutions offer real-time reporting and customizable options, enabling SMBs to enhance their customer service without a hefty investment.

In the financial sector, data security and compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) are paramount. Any breach can severely damage member trust and lead to significant financial penalties.

Enhancing security through features like single sign-on capabilities reduces vulnerabilities. Call recording can be paused to protect sensitive information, ensuring compliance with regulations. These measures help secure customer data while maintaining service efficiency.

High turnover rates and burnout can significantly impact call center performance. Keeping agents motivated and performing at their best is a constant challenge.

Regular monitoring of calls and interactions allows for the identification of areas needing improvement. Providing agents with real-time feedback and coaching can boost performance and morale. Furthermore, intuitive software interfaces reduce the need for extensive training, enabling agents to focus on delivering exceptional service.

Understanding customer behavior and preferences is essential for delivering personalized service. However, capturing and analyzing these insights can be daunting.

Advanced reporting tools provide insights into customer interactions and trends. Features like cradle-to-grave reporting and real-time visibility empower contact centers to understand customer needs better and proactively address common issues, turning customer service into a strategic advantage.

The challenges faced by credit union and small banking contact centers are significant, but with the right strategies and tools, they can be effectively addressed. By embracing advanced technology, ensuring data security, motivating agents, and leveraging customer insights, call centers can not only meet but exceed customer expectations. As the industry evolves, so too must the approach to customer service. Investing in these solutions today will pave the way for stronger customer relationships and a competitive edge in the financial services sector. Is your call center ready to take the next step? The time to act is now.

Clarity, Accountability, and Smarter Decision-Making for Healthcare Teams

Call center quality assurance (QA) is a structured process that helps ensure every customer interaction is handled with accuracy, professionalism, and care. By monitoring and

© 2025 Xima Software

XIMA, Xima logos, and other Xima trademarks are registered or unregistered Xima trademarks in the US and elsewhere. Other names or brands are trademarks of their respective owners.

Join us for an exclusive webinar as we dive into our latest product releases for IVR, MMS Messaging, and our Social Media Integration.

Thursday, September 12, 2024 | 11:00AM ET