In today’s financial world, trust is everything. But nothing erodes trust faster than long wait times, repetitive call transfers, and poor service experiences.

Customers don’t want to wait. And in banking—where seconds can mean missed opportunities or critical transaction failures—your contact center needs to be responsive, accurate, and ready to solve problems fast.

Here’s how AI can help reduce call volume while increasing customer satisfaction and long-term loyalty.

1. Predict Demand Before It Spikes

Why it matters:

Banks experience cyclical spikes—think payday, tax season, or rate changes.

How AI helps:

- Uses historical call data and seasonality trends to forecast surges

- Automatically adjusts resource allocation and IVR options in real time

- Helps you plan staffing ahead of time (without guesswork)

Pro tip: Combine AI forecasting with your CRM and calendar events (e.g., upcoming policy updates) for better alignment.

2. Use Virtual Agents for Routine Inquiries

Why it matters:

Not every call needs a human agent. Many are repeat, low-complexity requests.

How AI helps:

- Handles balance checks, password resets, transaction tracking

- Speaks natural language, not just button-press menus

- Works 24/7—no wait times

Bonus benefit: Your agents are freed up to handle more complex, higher-value conversations.

3. Make Self-Service Smarter (and More Visible)

Why it matters:

A clunky self-service experience drives customers back to the phone lines.

How AI helps:

- Recommends personalized help topics based on user history

- Analyzes failed self-service attempts to improve future UX

- Suggests smarter IVR routing paths

Quick win: Use AI-powered reporting to find out which knowledge base articles aren’t solving the issue—and fix them.

4. Spot the Bottlenecks with Real-Time Analytics

Why it matters:

Call volume isn’t always the problem—it’s what happens during the call.

How AI helps:

- Monitors live calls to detect long silences, repeat escalations, or call loops

- Flags coaching opportunities in real time

- Surfaces actionable patterns—like recurring issues after an app update

Fun fact: One retail bank reduced escalations by 30% just by refining how agents handled three common questions.

5. Automate the Follow-Up

Why it matters:

A huge portion of call volume is generated by follow-ups—“Did you get my form?” or “What’s the status of my request?”

How AI helps:

- Triggers proactive texts or emails when key actions are taken

- Updates customers on case status automatically

- Reduces the need for a second (or third) call

Smart move: Link automated follow-ups with service SLAs to avoid unnecessary call-backs.

6. Use Sentiment Analysis to Prioritize Urgency

Why it matters:

Not every call can be answered instantly—but some should be.

How AI helps:

- Detects frustration, confusion, or urgency in voice and text

- Re-prioritizes call queues in real time

- Sends alerts to supervisors for high-risk or high-value customers

Customer-first move: Use AI to identify at-risk customers and follow up before they leave.

7. Keep It Compliant

Why it matters:

Financial services are heavily regulated. Automation without oversight can be a risk.

How AI helps:

- Captures and logs every interaction in full detail

- Ensures disclosures are read, questions are answered

- Makes audits smoother with searchable transcripts

Trust booster: Transparent records and timely service create peace of mind for you and your customers.

The Bottom Line

Reducing call volume isn’t about deflection. It’s about delivering faster, better, smarter service—without sacrificing trust.

When AI is thoughtfully applied, it enhances the human side of your service operation. Your agents are less overwhelmed. Your customers feel more heard. And your business becomes more resilient.

Want to See What This Looks Like in Action?

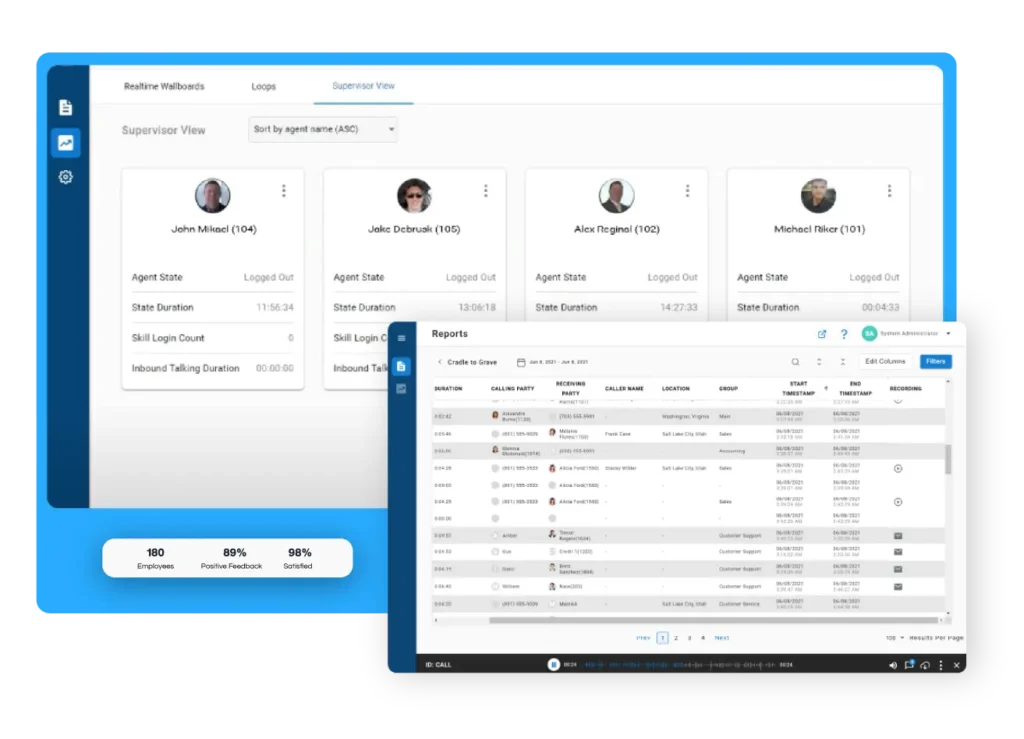

Solutions like Xima’s AI-powered analytics and self-service platform are helping financial services companies turn their contact centers into engines of efficiency and trust.

With real-time dashboards, intelligent call routing, and automated reporting, Xima helps teams spot issues before they escalate—and resolve them before they hurt your reputation.

Explore what’s possible with AI-driven contact center solutions built for financial services.