April is Financial Literacy Month, a fitting time to discuss not just how we manage money but also how financial institutions manage something even more valuable: data.

In today’s world, banks, credit unions, and fintechs are sitting on mountains of customer interaction data – call transcripts, chat logs, CRM histories, feedback scores, and more. The challenge? Turning all that noise into insight. That’s where AI-driven analytics makes a difference—particularly in customer service.

With AI, financial services companies aren’t just improving service metrics – they’re driving profits through faster, more intelligent, and personalized engagement.

Why AI Analytics Means Business in Financial Services

When it comes to customer service, every second counts. A faster resolution, a better answer, a more relevant offer—they all impact customer lifetime value, operational efficiency, and retention.

Here’s how AI analytics is moving the needle:

- Reducing handle times and call volume through intelligent routing and more innovative self-service

- Increasing CSAT and loyalty with personalized, real-time support

- Cutting compliance risk through live monitoring and alerts

- Improving agent productivity with data-driven coaching and performance feedback

AI is no longer just about efficiency—it’s becoming a revenue-generating tool for customer operations.

5 Examples of AI-Driven Analytics Creating Value

1. Predictive Call Routing

AI analyzes customer history, context, and sentiment to route calls to the most appropriate agent. Banks using this strategy have seen resolution times drop by up to 30%—saving costs while improving experience.

2. Real-Time Sentiment and Compliance Monitoring

AI listens in on calls in real time, flagging negative sentiment, frustration, or even language that risks non-compliance. This allows managers to intervene live, reducing risk and increasing first-call resolution.

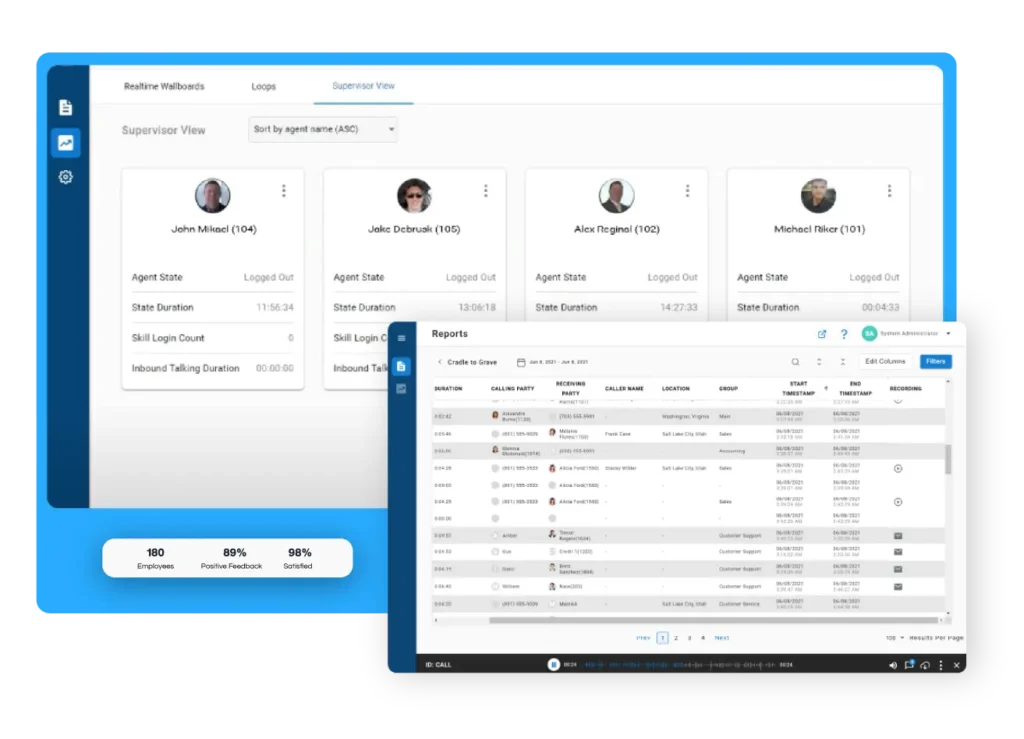

3. Agent Performance Analytics

By tracking key metrics like silence time, escalation rates, and resolution success, AI pinpoints coaching opportunities that help agents perform better. That translates into faster resolutions, more upsell opportunities, and better retention.

4. Self-Service Optimization

AI analytics helps uncover where digital or automated channels fail—why users drop off and still call. Fixing those moments can shift volume from expensive human interactions and lower cost-to-serve.

5. Customer Health Scoring

Looking across interactions, AI identifies customers at risk of churn or primed for an upsell. Teams can act proactively—whether it’s a retention campaign or offering the right product at the right time.

The Shift from Reactive to Revenue-Generating Service

Too many financial services teams are still in reactive mode—responding to issues as they arise. But the leaders are using AI to proactively shape customer behavior and value:

- Reaching out before complaints escalate

- Prioritizing callbacks based on value or urgency

- Personalizing support journeys to drive conversions

What used to be a cost center is now a growth engine.

How to Build an AI-Powered Service Operation

If you’re leading customer experience or service operations in financial services, here’s how to start unlocking value from AI analytics:

- Start with what you already have. Every call, chat, and feedback score contains insight. Use a platform like Xima to capture and surface what matters.

- Pick a high-impact target. Whether it’s churn reduction, upsell conversion, or reducing AHT, aim for a measurable win that impacts revenue.

- Close the loop with coaching and action. AI is powerful, but value is only realized when humans act on the insight—make sure your teams are empowered to follow through.

Final Thoughts

In financial services, the stakes are high—and the margins for error are small. Customers expect faster, smarter, more personal service, and if you don’t deliver, someone else will.

AI analytics helps teams not just meet those expectations but exceed them while improving the bottom line. It’s not just about data. It’s about what you do with it.

The most innovative banks and credit unions are no longer just managing support—they’re turning it into a profit center.

That’s what it means to bank on intelligence.