In finance, trust is currency. Customers expect every interaction, whether checking a balance or applying for a loan, to be fast, seamless, and secure. Meanwhile, institutions must navigate a web of compliance regulations, ranging from GLBA to PCI DSS, while also controlling operational costs.

This is where artificial intelligence is quietly transforming financial contact centers. Not with flashy promises, but with practical tools that monitor conversations, reduce human error, streamline disclosures, and protect sensitive data, all in real time.

The result? Better service. Stronger compliance. And teams that are empowered, not overwhelmed.

The Compliance Landscape: High Stakes, Constant Change

Financial institutions face some of the most stringent compliance requirements across any industry. Contact centers are expected to:

- Verify identities quickly

- Deliver required disclosures at the right time

- Handle and store sensitive financial data securely

- Maintain detailed audit trails

- Detect and prevent fraud or inappropriate language

Doing all this manually is not only costly but also prone to error. AI-enabled platforms are bridging this gap by providing real-time oversight, automated workflows, and data-driven insights that ensure operations run smoothly and securely.

Where AI Delivers Immediate Value

These are not hypothetical benefits. Today’s intelligent contact center platforms offer purpose-built capabilities that map directly to financial compliance and customer experience goals.

Real-Time Compliance Monitoring

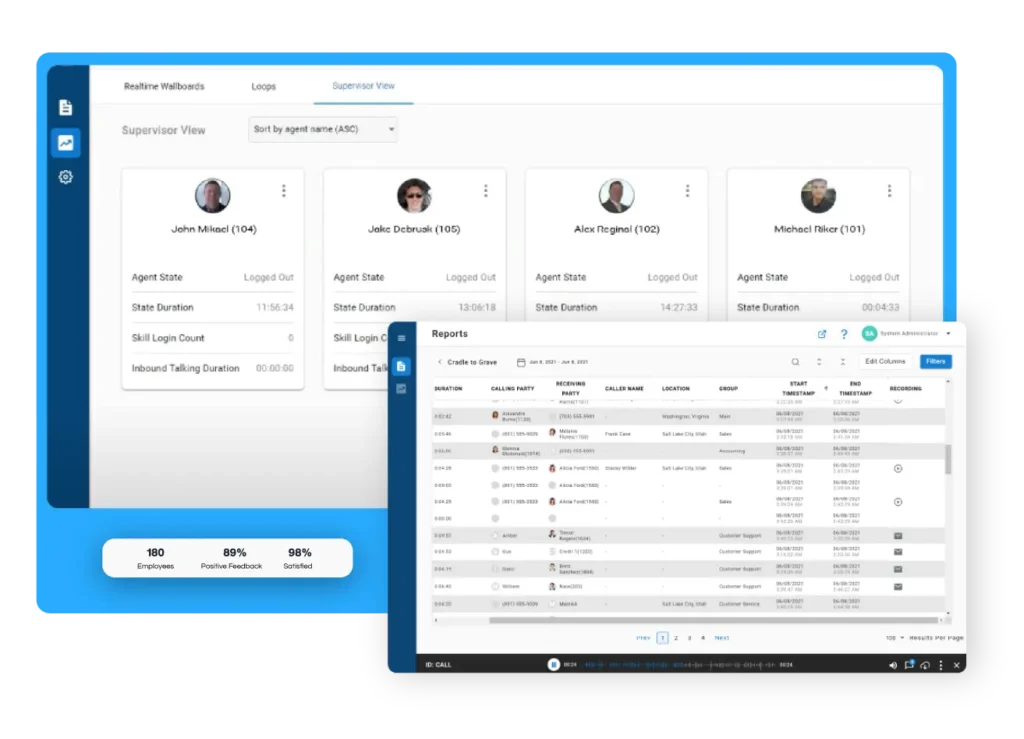

AI-driven tools can automatically evaluate every interaction, flagging missed disclosures, inappropriate language, or deviations from compliance scripts as the conversation unfolds. Agents receive real-time guidance to correct course, and supervisors can intervene when needed.

Identity Verification and Data Redaction

Voice authentication, behavioral analytics, and automated redaction features help ensure that customer identities are verified securely and sensitive information is never exposed. Whether it is account numbers, SSNs, or card details, the system protects them in the moment, not after the fact.

Intelligent Disclosures and Consent Tracking

Consent is not just a checkbox. It is a requirement. AI-powered systems can prompt agents to deliver necessary disclosures at precisely the right time, while automatically tracking and logging customer consent for marketing, data sharing, or legal notifications.

Driving Efficiency Without Sacrificing Control

Financial contact centers must operate efficiently, but they also cannot cut corners. AI enables faster resolution times and consistent service without putting compliance at risk.

Sentiment Analysis and Real-Time Coaching

Modern systems can detect when a customer is frustrated, confused, or at risk of dropping off and suggest in-the-moment guidance to the agent. That means better outcomes for customers and fewer escalations for teams.

Intelligent Routing Based on Intent

AI can analyze what a customer says in the first few seconds and route them to the correct department or specialist, reducing call transfers and resolution time in a world where speed matters. This is a game changer.

Multichannel Consistency

Whether a customer contacts your institution via phone, chat, or email, AI ensures consistent language, compliant handling of sensitive information, and accurate documentation across every channel.

Supporting Compliance and QA Teams

Compliance officers and QA teams are the unsung heroes of financial operations. AI helps them scale their oversight and focus on what matters most.

Automated Call Scoring and Quality Review

Instead of manually reviewing a small sample of calls, AI can evaluate every interaction against customizable benchmarks for compliance and performance. Teams can then focus their efforts on coaching and continuous improvement.

Instant Audit Trails and Reporting

Every action, disclosure, and consent is automatically logged, making it easier to generate reports, respond to audits, and demonstrate adherence to financial regulations.

A Smarter, Safer Path Forward

For financial institutions, AI is not about replacing people; it’s about augmenting them. It is about supporting them with intelligent tools that make service more secure, compliance more achievable, and customer experiences more personalized.

Whether you are managing growing call volumes, new regulatory mandates, or higher customer expectations, AI gives you the insight and control to deliver at scale without compromising on trust.

Because in finance, every word matters. And with the right tools in place, every word can be the right one.