Most mid-sized and regional financial institutions set out to be different. More personal. More responsive. Closer to the customer than the big national banks ever could be.

That’s how they win loyalty – by answering calls quickly, knowing customers by name, and solving problems without bouncing people between departments.

But as the business grows – more branches, more customers, more services, something starts to slip. Hold times get longer. Cases pile up. The team is stretched thin. The warmth that once defined the experience begins to fade, replaced by scripts, ticket numbers, and impersonal interactions.

Suddenly, the institution you built to be better starts looking and feeling like the ones you swore you’d never emulate.

The Challenge: Growing Without Becoming a Bank You Wouldn’t Bank With

Growth brings complexity. You’re juggling more customers, more regulations, more communication channels, and more expectations. But unlike the big national banks, you don’t have an unlimited budget or an endless call center staff.

You can’t just throw people at the problem. And even if you could, that’s not the point. You want to grow and stay true to what made your institution different in the first place.

So, how do you do it?

More innovative Systems, Not Just Bigger Teams

The answer isn’t hiring more. It’s enabling the team you already have with tools that let them scale their impact. That’s where intelligent automation and AI-driven analytics come in. They’re not just about efficiency. They’re about preserving the human connection at scale.

Here’s How Modern Automation Helps Financial Institutions Grow With Heart

- Keep Simple Inquiries Out of the Queue

When 40 percent of your calls are password resets, balance checks, or routing number requests, your staff doesn’t have the bandwidth to handle the real issues. Virtual agents and self-service tools deflect routine questions while still delivering accurate, immediate answers, freeing up your team to focus on meaningful conversations. - Give Every Rep the Full Picture

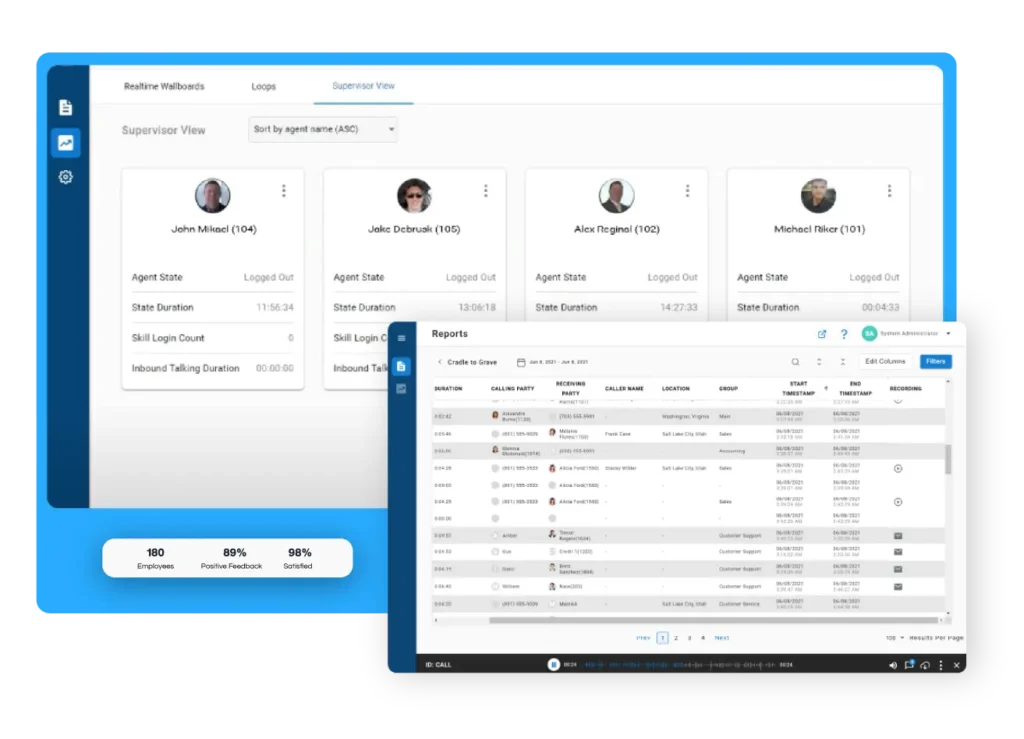

Nothing kills the personal touch like making a customer repeat themselves. AI-powered contact center platforms can surface customer history, prior interactions, and sentiment in real time, so even if it’s the first time you’ve spoken to them, it doesn’t feel like the first time they’ve talked to you. - Use Data to Improve the Experience—Not Just Report on It

Analytics shouldn’t just live in quarterly reports. Real-time dashboards can help managers see when the queue is backing up, where agents are overwhelmed, and what kinds of issues are trending. That’s how you spot service breakdowns before they become customer complaints. - Deliver Consistency Without Losing Authenticity

AI can help suggest responses and guide agents through workflows without forcing them into robotic scripts. That keeps the experience efficient and compliant, but still conversational and human, exactly how your institution started.

This Isn’t About Replacing People. It’s About Protecting Them.

Your service team is your front line. Burn them out, and your entire customer experience suffers. But with the right tools in place, you can reduce repetitive strain, improve response times, and keep the team focused on what they do best: connecting with customers.

Where Xima Fits In

Xima gives growing financial institutions the tools to support more customers without sacrificing what makes them special. From intelligent automation and queue management to real-time analytics and personalized service tools, Xima helps mid-sized banks and credit unions stay nimble, efficient, and deeply human, even as they scale.

If you’re committed to delivering big-bank capabilities with small-bank heart, Xima can help you grow without losing your way.