There’s a constant tug-of-war happening behind the scenes in financial services. One side demands exceptional customer service—fast response times, accuracy, and availability across channels. The other side demands leaner operations and strict cost control.

For many banks, credit unions, and insurance providers, managing this tension comes down to a single question: Do we have the right people in the right place at the right time?

That’s where AI-powered workforce management makes the difference—not by adding complexity, but by making smarter use of the data financial contact centers already generate.

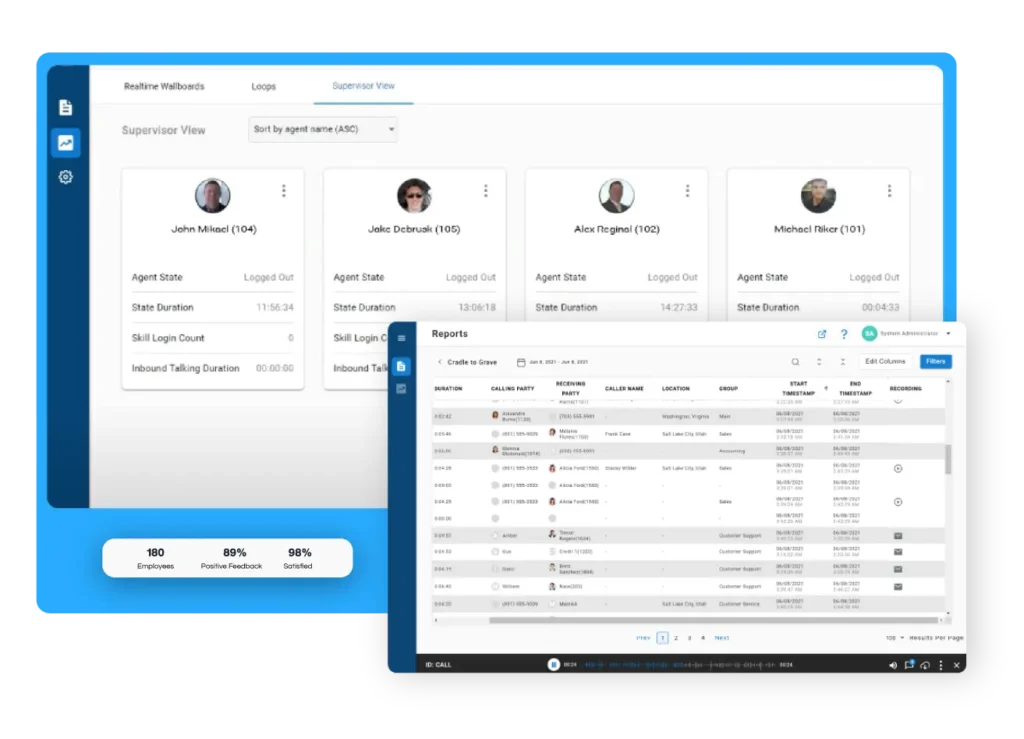

Precision Staffing Backed by Real-Time Data

Too many scheduling decisions are still based on old assumptions—yesterday’s call patterns, average volume estimates, or inflexible weekly plans. But customer demand in financial services isn’t static. It shifts with market cycles, product launches, rate changes, and even the news cycle.

With AI-powered analytics for contact centers, teams can anticipate demand and adjust staffing dynamically. That means:

- Proactively scheduling around high-volume events (e.g., tax season, policy renewals)

- Real-time reallocations to balance queue loads and reduce wait times

- Identifying patterns that lead to missed SLAs before they happen

A McKinsey report found that organizations leveraging AI and workforce analytics reduce contact center costs by up to 30%—without compromising service quality.

Supporting Agents to Prevent Burnout

Handling sensitive customer issues—like fraud alerts, loan decisions, or claims disputes—requires emotional resilience and sharp attention to detail. But without visibility into workload distribution or warning signs of agent fatigue, even the best teams can burn out.

With real-time dashboards and time-in-state monitoring, supervisors can intervene early and maintain a sustainable pace for agents. This is especially important in financial contact centers where precision and empathy go hand in hand.

Agent burnout not only increases attrition but also reduces service quality and compliance—two things financial institutions can’t afford to compromise.

Managing Spikes With Smarter Chat Integration

During high-demand periods, live voice support often becomes overwhelmed. But adding more phone agents isn’t always an option. That’s where chat tools come in.

Modern AI messaging bots can handle high-frequency, low-complexity tasks like password resets, balance checks, or application status updates—before an agent ever needs to step in. When escalation is needed, chats can be handed off seamlessly with full context.

This approach helps:

- Reduce wait times across all channels

- Free up phone agents for more complex cases

- Maintain 24/7 availability without staffing overnight shifts

Chatbots are quickly becoming standard in omnichannel strategies. Used correctly, their role is to augment—not replace—human agents by handling volume spikes and improving overall efficiency.

Maintaining Quality at Scale

Growth doesn’t have to mean sacrificing service quality. Whether scaling support for new regions, product offerings, or customer segments, smart routing and queue management ensure every customer reaches the best available resource.

With contact center software for financial services, teams can use features like skills-based routing, historical insights, and queue optimization to:

- Resolve issues faster

- Reduce escalations

- Ensure consistency across agents and shifts

In heavily regulated sectors like banking and insurance, maintaining service standards is non-negotiable—no matter how quickly you grow.

From Reactive Management to Predictive Strategy

Most contact centers still operate reactively—adjusting schedules after performance drops or reacting to surges in real time. But AI changes the game by enabling a predictive approach to staffing.

Research from PwC shows that financial institutions integrating automation and real-time analytics into operations can eliminate manual bottlenecks, enable proactive alerts, and save between $20–40 million annually.

Source: PwC – Analytics and Automation in Financial Services

With the right data, leaders can:

- Forecast call and chat volume down to the hour

- Simulate “what-if” staffing scenarios before making changes

- Track performance across time and channels for continuous improvement

When data is centralized and accessible, decision-makers can move from reacting to leading.

Efficiency, Quality, and Balance Are Within Reach

Workforce management powered by AI and analytics doesn’t mean replacing people—it means empowering them. Financial organizations that adopt these strategies are proving it’s possible to:

- Align staffing levels with actual demand

- Protect agent wellbeing in high-pressure environments

- Preserve a high standard of service across every interaction

In the end, balancing efficiency and customer experience isn’t a tradeoff. It’s a design decision—and modern contact center platforms give you the blueprint.

Further Reading:

- AI-Powered Analytics for Contact Centers

- Contact Center as a Service: What You Need to Know

- Workforce Optimization in Financial Services