Save Money with Xima: Affordable RingCentral Alternative

Searching for RingCentral alternatives? Save money with Xima’s feature-rich contact center software, built for SMBs to improve support and cut costs.

In today’s fast-paced financial landscape, call centers play a pivotal role in shaping the member experience. However, many financial institutions struggle to keep pace with evolving customer expectations and technological advancements. Long wait times, cumbersome automated systems, and frequent call transfers can frustrate customers and impede revenue growth. In this blog post, we will explore the key challenges faced by financial services call centers and provide actionable solutions to enhance member satisfaction and loyalty.

Customers today expect prompt service, and extended wait times can lead to dissatisfaction and lost business. Many call centers serving small banks and credit unions rely on outdated automated menus that leave customers feeling trapped in an endless loop.

Implementing advanced queue callback features can significantly reduce wait times. By allowing members to choose their preferred communication channel—whether it’s voice, email, text, or web chat—institutions can offer a more personalized experience. Additionally, using Interactive Voice Response (IVR) systems can quickly resolve routine inquiries without the need for live agents.

A lack of service options and frequent call transfers can create a frustrating experience for members. They want their issues resolved quickly and efficiently, without being bounced from one department to another.

Providing an omnichannel approach with seamless integration across various communication platforms is essential. With tools like skills-based routing and flexible call routing, agents can quickly identify a member’s financial history and provide personalized recommendations. Ensuring that agents are empowered to resolve issues without constant escalations can also improve efficiency and customer satisfaction.

Customers increasingly expect personalized interactions and empathetic service, especially when dealing with sensitive financial matters. Call centers that rely on scripted responses often fail to meet these expectations.

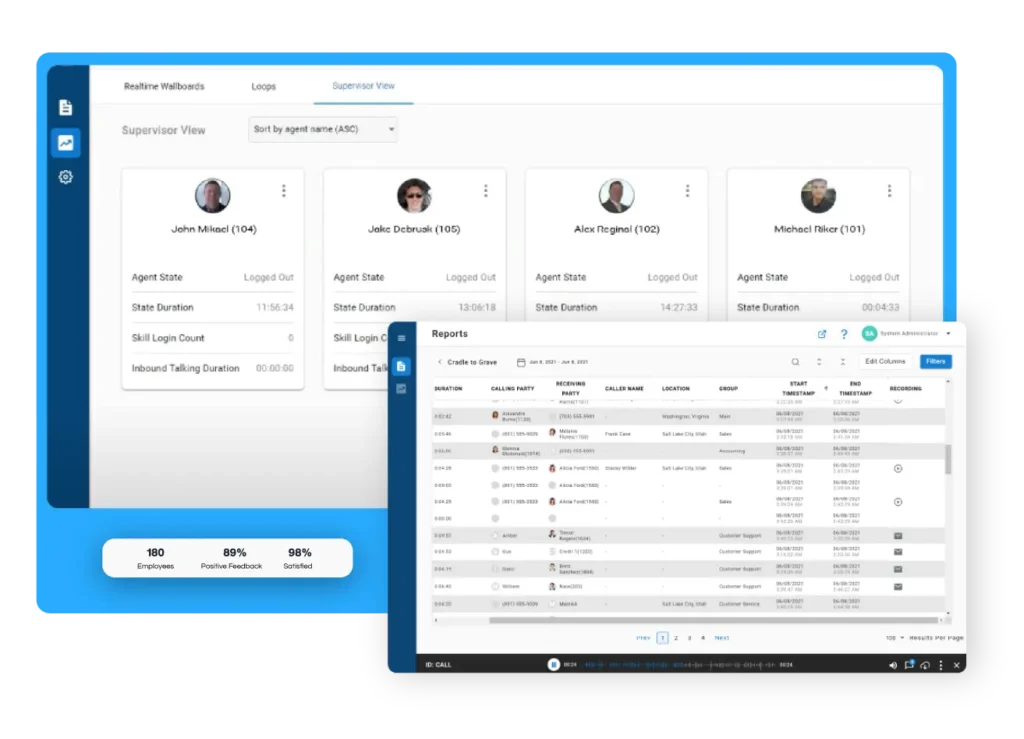

Utilizing customer insights and real-time data analysis can help agents personalize interactions and demonstrate empathy. By equipping agents with the right tools and information, they can better understand customer needs and deliver a more tailored experience. Real-time wallboards and cradle-to-grave reporting offer agents and supervisors the insights they need to continuously improve service quality.

With the increasing number of security breaches, safeguarding sensitive member information is a top priority. Mishandling financial data can lead to severe consequences, including identity theft and loss of trust.

Enhancing security measures with features like single sign-on capabilities can protect customer data while maintaining administrative convenience. Ensuring that call recordings are compliant with regulations such as HIPAA further safeguards sensitive information.

Financial services call centers must adapt to meet the growing demands of their members.By addressing key challenges such as long wait times, lack of personalization, and security concerns, institutions can create a more efficient and satisfying customer experience. Embracing innovative solutions like omnichannel communication and data-driven insights will not only enhance customer loyalty but also drive revenue growth. It’s time for financial services call centers to become a strategic asset in building stronger customer relationships. Contact us today to explore how our solutions can transform your call center operations and elevate your customer service to new heights.

Searching for RingCentral alternatives? Save money with Xima’s feature-rich contact center software, built for SMBs to improve support and cut costs.

For small and midsize businesses, customer conversations happen everywhere. Calls, emails, chats, texts, and internal messages often live in separate systems. When those systems do

Join us for an exclusive webinar as we dive into our latest product releases for IVR, MMS Messaging, and our Social Media Integration.

Thursday, September 12, 2024 | 11:00AM ET