What are the challenges of handling high call volumes?

High call volumes often result in longer wait times, which can frustrate customers and lead to exhausted agents. During peak times, the volume can overwhelm even the most well-prepared call centers, causing a decline in service quality.

Solution: Embrace Self-Service and Automation

To combat high call volumes, implementing self-service options and automation can significantly reduce the burden on call centers. Technologies like chatbots, Interactive Voice Response (IVR) systems, and online resources empower members to resolve simple issues independently. This approach not only frees up agents to focus on complex inquiries but also enhances the customer experience by providing faster resolutions.

How do complex customer inquiries impact call centers?

Financial services often involve intricate products and services that require in-depth knowledge and expertise to address customer queries. Complex inquiries can slow down service and create bottlenecks, impacting member satisfaction.

Solution: Equip Agents with Advanced Technology

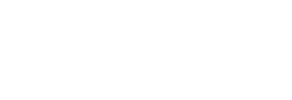

Providing call center agents with advanced technology tools can streamline workflows and improve service delivery. Utilizing Customer Relationship Management (CRM) systems, AI-driven insights, and omnichannel platforms enables agents to handle member interactions more effectively. These technologies allow agents to quickly access relevant information and deliver personalized solutions, enhancing the overall service quality.

What challenges arise from regulatory compliance?

Ensuring compliance with ever-evolving financial regulations is critical for call centers, but it can be challenging to keep up with changes. Non-compliance can lead to legal issues and damage the institution’s reputation.

Solution: Implement Comprehensive Security and Compliance Measures

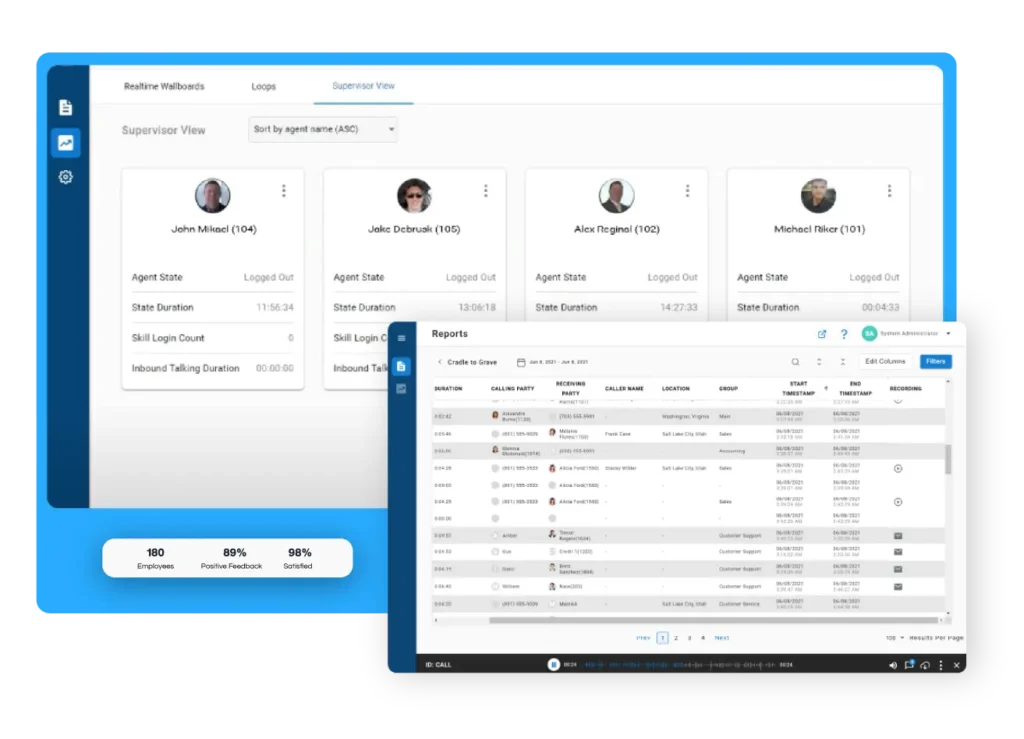

Financial services call centers must prioritize robust security measures and adherence to regulatory requirements to protect sensitive member information. Implementing advanced authentication protocols, encryption technologies, and regular audits helps safeguard data and ensure compliance. Automated systems can track and document member interactions, providing a clear audit trail and reducing the risk of non-compliance.

How does agent burnout affect call center performance?

The high-pressure environment of financial services call centers can lead to agent burnout, resulting in reduced productivity and higher turnover rates. This challenge affects service quality and increases recruitment and training costs.

Solution: Focus on Continuous Training and Development

Investing in ongoing training, coaching, and development is essential to keep agents engaged and equipped to handle diverse customer needs. A well-trained team is more likely to maintain high service standards and provide exceptional member experiences. Additionally, flexible communication methods and queue callback options can help manage workload and prevent burnout by ensuring agents are connected with the right tasks that match their expertise.