Essential Credit Union is a community-chartered credit union founded in 1972 by a group of Dow Chemical employees in Baton Rouge, Louisiana. Offering outstanding financial services at low cost to more than 46,000 members, Essential manages $378 million in assets. In addition to a growing set of physical branches, the organization also offers web and telephone services.

Essential’s primary contact center in Baton Rouge employs eight full-time agents and handles all incoming calls. Agents are trained to handle inquiries on all products and services, with the goal of being able to resolve issues within a single call. Although the contact center was performing well, Essential recognized shortcomings with its existing management software and set out to find new contact center software that would allow it to continue with its existing telephony provider.

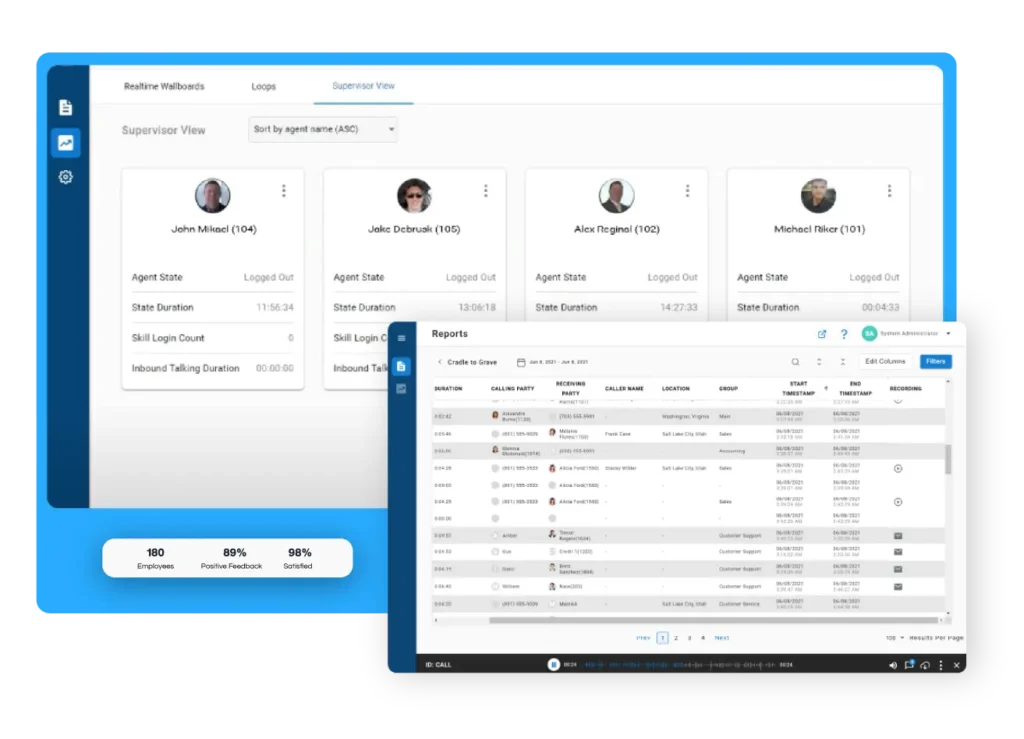

Based on a recommendation from a trusted partner, the Essential Credit Union team looked at Xima, a cloud-based solution for modern contact centers. The solution offered everything Essential was looking for—standard features such as call priority, call forecasting and pre- and post-disposition, but also post-call surveys and modules for workforce management and optimization.

Xima provided an onboarding consultant to review Essential’s requirements and recommend best practices. The implementation team built custom service-level and agent-working-rate reports, delivered supervisor training, tested the solution and provided post-go-live hypercare for the critical first 30 days.

“With Xima in place, we can work more effectively and deliver more consistent levels of service to our members.”

– Tee Collins

Call Center Manger, Essential Credit Union

Agents are incentivized on several metrics including call handle time, average call abandoned rate and overall service level. Before Xima, group targets were often missed. Now, handle time, average wait time and abandoned percentage have all fallen, producing incentives for team members. Overall service level hit 90% in December, having fluctuated between 50 and 70% before the adoption of Xima.

Live metrics from Xima are displayed on wall-mounted screens in the contact center, making performance visible to the organization as a whole. This underscores the collective commitment to serve members as diligently as possible.

“The contact center is a vital channel for answering routine questions and keeping departmental teams free to work on other priorities. It’s therefore very important that our agents have the best software to manage calls. With Xima in place, we can work more effectively and deliver more consistent levels of service to our members.”

– Tee Collins

Call Center Manager, Essential Credit Union

Essential is now turning its attention to rolling out workforce management with Xima. By analyzing call data, the organization expects to reveal actionable insights into member behavior as well as better predicting incoming call volumes for more efficient operations.

“We’re looking forward to taking advantage of all the features that we have with Xima,” concludes Collins. “Working with the Xima team has been great so far. Anytime I’ve brought something to their attention, they have been resourceful in remedying things and sharing best practices.”

In just a few minutes get your personalized demo and see how you can elevate your customer service experience at a fraction of the cost.

Get your questions answered and learn why thousands of companies around the world use Xima.

© 2023 Xima Software

XIMA, Xima logos, and other Xima trademarks are registered or unregistered Xima trademarks in the US and elsewhere. Other names or brands are trademarks of their respective owners.

Join us for an exclusive webinar as we dive into our latest product releases for IVR, MMS Messaging, and our Social Media Integration.

Thursday, September 12, 2024 | 11:00AM ET