In financial services, trust is the foundation of every relationship. When members reach out with concerns about a transaction, a claim, a loan status, or a policy update, they’re seeking clarity and reassurance. But by the time they make that call, doubt or frustration may already be growing.

Most banks, credit unions, and insurers still operate in reactive support models, only addressing issues after members reach out. That leads to friction, repeat calls, and easily preventable dissatisfaction—often around issues that were entirely predictable.

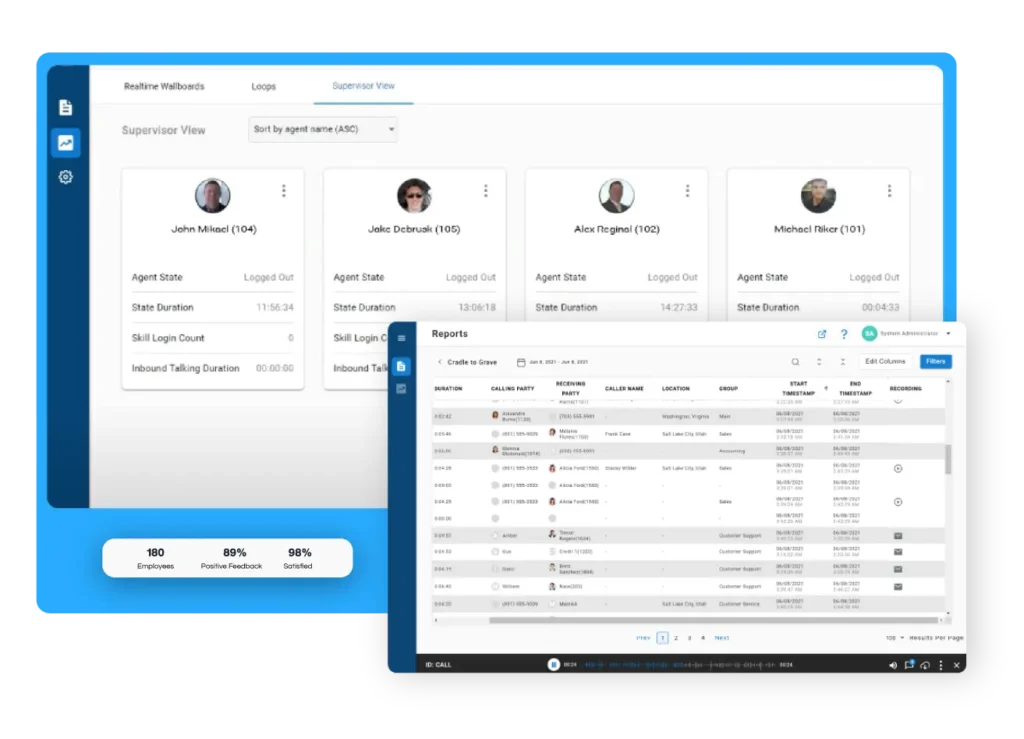

Xima’s predictive AI changes the equation.

By analyzing member behavior and interaction trends, Xima helps financial institutions deliver guidance, outreach, and reassurance before the member even thinks to call.

Where Reactive CX Falls Short in Financial Services

Staying reactive creates operational strain and weakens trust:

- Members contact support repeatedly for the same issue

- Agents lack context and waste time gathering information

- Call volume spikes without warning

- Preventable confusion damages loyalty

- Issues escalate unnecessarily

Yet member journeys follow recognizable patterns and behavioral cues that flag emerging needs.

Xima helps you catch those signals early.

Using Predictive AI to Strengthen Member Loyalty

Xima transforms raw behavioral data into actionable insights that help banks, credit unions, and insurers support members proactively and confidently.

1. Predicting Common Member Issues

Members frequently call about:

- Loan application or underwriting updates

- Card declines or fraud concerns

- Policy questions and claim status

- Payment, billing, or transfer errors

- Account changes or form completion issues

Xima identifies patterns that indicate when a member is likely preparing to call and triggers proactive communication like reminders, clarifications, and next steps that reduce frustration and reassure the member.

2. Identifying At-Risk or Confused Members

Behavioral signals—such as repeated login attempts, incomplete applications, or sudden policy adjustments—often indicate confusion or concern.

Xima flags these members early, enabling financial institutions and credit unions to:

- Provide guidance before friction escalates

- Reduce churn risk

- Strengthen transparency and trust

A proactive message at the right moment can prevent a call and preserve confidence.

3. Reducing Call Spikes Across Branches and Contact Centers

Seasonal patterns, policy renewals, economic shifts, or regulatory updates frequently cause unpredictable surges.

Xima predicts these spikes and enables institutions to respond before demand overwhelms teams. This includes:

- Preemptive FAQs

- Timely reminders

- Claim or loan status updates

- Personalized outreach for high-risk members

The result is smoother operations across call centers and branches—and happier members.

A More Reassuring, Transparent Member Experience

Proactive outreach isn’t just a convenience, it’s a trust-building strategy.

Financial institutions see meaningful gains:

- Faster issue resolution

- Lower inbound call volume

- Improved member confidence

- Higher loyalty and satisfaction

- More personalized, consistent communication

When members feel supported proactively, they feel valued and stay longer.

Why Banks, Credit Unions, and Insurers Choose Xima

Xima is built to make predictive insights easy to understand and act on. Institutions choose Xima because it:

- Integrates seamlessly with existing contact center and CRM systems

- Surfaces clear, actionable predictions not overwhelming data

- Supports compliant, personalized communication

- Grows with expanding data and member needs

Instead of guessing what members need, Xima helps you stay a step ahead—delivering service that feels modern, secure, and deeply member-centric.

The Future of Financial Support Is Predictive

Members shouldn’t have to chase updates about their accounts, policies, or transactions.

They shouldn’t wait in call queues for information that could have been sent automatically.

And service teams shouldn’t rely on reactive troubleshooting.

With Xima’s predictive AI, financial institutions can anticipate member needs and deliver proactive support that builds trust, reduces volume, and strengthens loyalty.

Helping members before they call isn’t just smart service, it’s the new standard in financial experience.