When Minutes Mean Money

Few customer interactions carry more weight than those with financial institutions. A call is not just about checking a balance or asking about hours, it can mean reporting fraud, disputing a charge, or trying to secure a loan.

In those moments, time feels different. Every extra minute on hold, every repeated explanation, every transfer to another department adds stress. For the customer, trust hangs in the balance. For the institution, long interactions quietly increase costs and risk.

That is why Average Handle Time (AHT) matters in financial services. It is not about rushing people off the phone. It is about showing customers that their money and their peace of mind are handled with speed, accuracy, and care.

The Hidden Cost of Long Calls

When calls drag on, the impact runs deeper than a longer phone bill.

- Operational cost: High AHT means fewer cases per agent, more staffing pressure, and rising expenses.

- Customer stress: Repeating details or waiting in silence can make customers feel ignored or insecure, especially during fraud or dispute cases.

- Reputation risk: In a competitive market, even one poor experience can send a customer looking elsewhere.

In financial services, time is not just money, it is trust.

How Faster Resolutions Happen

Improving AHT in finance is not about shortcuts, it is about clearing away the barriers that slow agents down and frustrate customers.

- Guided Workflows Keep Calls on Track

Fraud alerts, loan checks, and compliance steps can be complex. Guided workflows help agents follow the right process every time, avoiding errors while keeping calls smooth and efficient. - Smarter Data Access Reduces Repetition

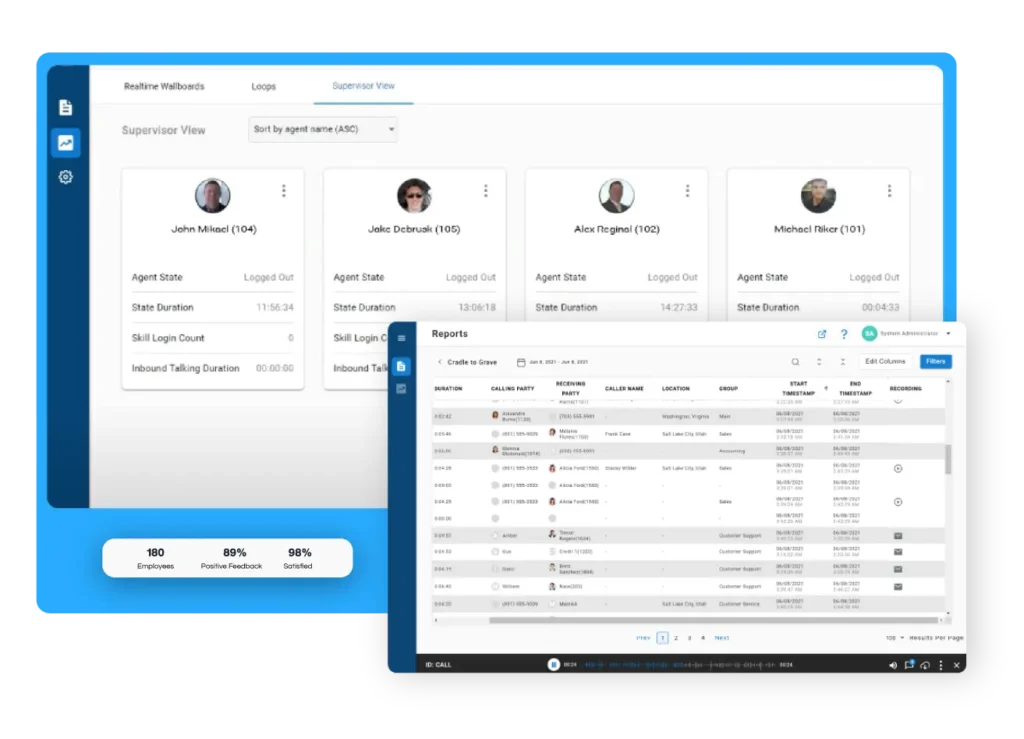

When account history, notes, and previous interactions are visible in one place, customers do not have to explain themselves again and again. Agents resolve issues faster with fewer mistakes. - AI Insights Reveal Patterns

By analyzing calls for trends, like a spike in fraud reports or common delays in dispute resolution, leaders can address issues at the root, coach agents effectively, and prevent repeat problems. - Flexible Channels Lower Abandonment

Sometimes customers just need a quick answer. Options like secure chat or scheduled callbacks reduce frustration, cut down on dropped calls, and still keep service personal.

The ROI of Speed and Trust

For financial institutions, lowering AHT is not just an internal win, it is a financial strategy.

- Handle more calls per agent without increasing headcount.

- Cut repeat calls and rework by getting issues right the first time.

- Improve retention and cross sell opportunities by building trust in stressful moments.

ROI here is twofold: less operational waste and more loyalty. Faster resolutions save money today and strengthen relationships that drive value tomorrow.

Case in Point: Essential Credit Union

When Essential Credit Union modernized their contact center, they needed more than efficiency, they needed to improve the member experience. With Xima, they gained clearer reporting, reduced inefficiencies, and gave staff the tools to respond quickly and confidently.

The result? Members got answers faster, staff had more control, and leadership could finally see the data behind performance. Read the full story here.

Closing Thought

Financial services are built on trust. And trust is most fragile in moments of stress, like a fraud report or a billing dispute.

That is why faster resolutions matter. Guided workflows, smarter data access, AI insights, and flexible channels all help shorten calls without cutting corners. The outcome is not just lower AHT, it is stronger relationships, lasting loyalty, and measurable ROI.

Because in financial services, every second counts.